The DeFi Paradox: How Scam Tokens Power the Most Trusted DEX Analytics Platform—and What It Means for Your Crypto Journey

Stop scrolling. What if the platform you rely on to navigate decentralized finance is both your best ally and your biggest blind spot? DEX Screener, with its soaring traffic and cutting-edge blockchain indexing, is hailed as a beacon for traders. Yet, beneath this technical marvel lies a paradox: it thrives by showcasing tokens that many consider scams. How can a platform so integral to millions also be a conduit for risk? The answer reshapes everything we think about trust, information asymmetry, and the behavioral quirks driving crypto markets. Buckle up: this isn’t just about a tool—it’s about the invisible forces sculpting your crypto decisions.

When Trust Becomes a Double-Edged Sword

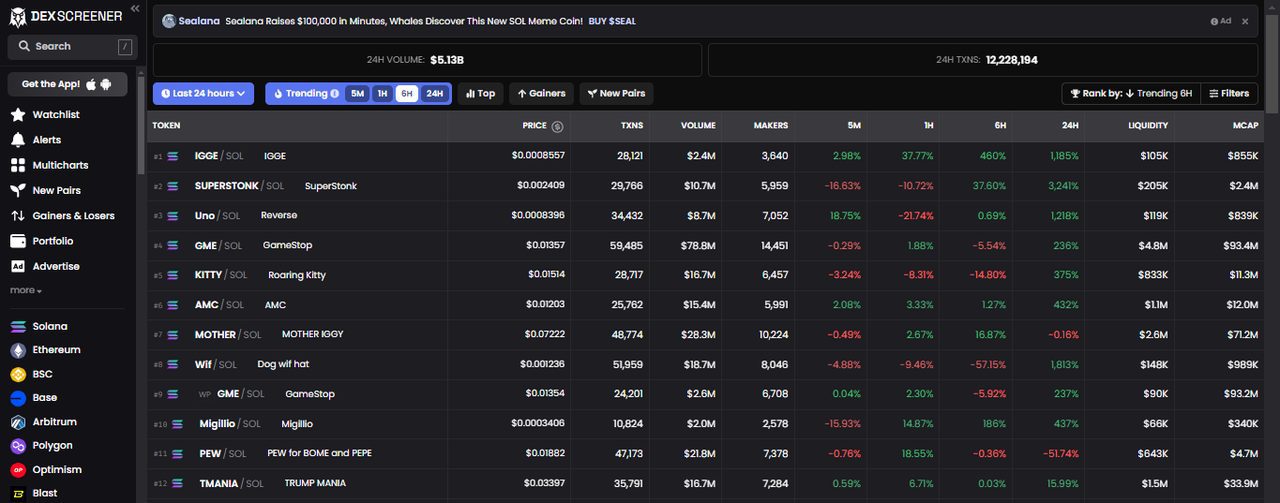

DEX Screener’s rise is staggering. Founded in 2021, it now commands over 1.5 million monthly active users and covers 80+ blockchains with real-time analytics. Its proprietary blockchain indexer eschews third-party APIs, offering unparalleled data freshness and accuracy—a technical fortress in the volatile DeFi landscape. Yet, this fortress harbors a controversial underbelly: paid token listings and promotional “boosts” that flood the platform with dubious projects. In January 2025, Coinbase’s product lead publicly condemned DEX Screener’s “dark patterns” for featuring scam tokens prominently, alleging up to $200 million in revenue from these practices.

This revelation flips the conventional wisdom that transparency equals safety. Instead, it exposes a behavioral paradox: traders flock to the platform for clarity, but that very trust is weaponized by token promoters exploiting human biases like social proof and FOMO. The platform’s freemium model—free core features paired with lucrative paid promotions—creates a “trust-nudge” ecosystem where cognitive overload and anchoring bias keep users locked in despite red flags.

Down the Rabbit Hole: When Data Precision Meets Behavioral Blind Spots

DEX Screener’s brilliance lies in its microservices architecture and direct blockchain node connections, which deliver updates every few seconds across thousands of tokens. Its integration with TradingView’s advanced charting tools empowers traders with technical signals, whale tracking, and multi-chart correlation. Yet, the very abundance of data risks overwhelming users, triggering bounded rationality and choice overload.

Here lies the hidden systemic connection: the platform’s automated trending algorithms and paid “Boost” features skew attention economics by inflating certain tokens’ visibility. This manipulation exploits prospect theory and loss aversion—traders hesitate to miss out on “trending” coins, often ignoring impermanent loss risks or slippage. In other words, DEX Screener is not just passively reflecting market dynamics—it actively shapes them through incentive design and behavioral nudges embedded in the UI.

For traders looking to go here for the latest tools, this means the very signals they trust may be engineered traps. Yet, paradoxically, this ecosystem supports an active, engaged user base, fueling DEX Screener’s staggering $150,000-$250,000 daily revenue from token promotions. The platform’s unique “freemium paradox” thus becomes a behavioral feedback loop reinforcing its market dominance while magnifying reputational risks.

From Technical Moat to Reputation Abyss: The High-Risk, High-Reward Model

DEX Screener’s proprietary blockchain indexer is a technological moat few competitors can breach. Unlike platforms relying on external APIs, it parses raw blockchain logs directly across 80+ Layer 1 and 2 networks, delivering unmatched speed and accuracy. This infrastructure supports millions of users with a lean team of fewer than ten employees, yielding an astonishing $25-$31 million revenue per employee ratio—a feat of operational efficiency rarely seen in crypto.

Yet this technical supremacy collides with an existential threat: reputational damage from persistent accusations of promoting scam tokens and market manipulation. The platform’s low Trustpilot score (1.8 stars) and high user complaints about fraudulent listings create a trust deficit. This “reputational paradox” challenges the notion that superior technology alone guarantees sustainable success in crypto analytics.

Moreover, regulatory uncertainties loom large. As DeFi grows—projected to reach $616 billion by 2033—platforms like DEX Screener face intensified scrutiny over their monetization of token advertising and potential complicity in market abuse. Their “dark pattern” tactics could invite legal crackdowns, forcing a rethink of transparency and ethical standards. For traders, this means navigating not only market risk but also evolving regulatory landscapes and platform governance challenges.

Behavioral Alchemy: Turning FOMO Into an Analytics Superpower

What if the very behavioral biases threatening trader rationality also fuel DEX Screener’s success? The platform harnesses social proof and urgency effects through “Boost” packages and trending scores, transforming FOMO from a liability into a revenue engine. This “behavioral alchemy” leverages cognitive overload and Pavlovian response patterns, keeping users glued despite the risk of overtrading or falling prey to scam tokens.

DEX Screener’s integration of automated price alerts, Telegram trading bots, and whale tracking further deepens this dynamic. By nudging traders with real-time, personalized signals, it creates a “digital dopamine loop” that blends data precision with emotional triggers. This synthesis of on-chain analytics with behavioral KPIs exemplifies a new frontier in crypto UX design—one where the platform’s power is as much psychological as technological.

Understanding this framework equips traders to transcend the “trust trap.” By recognizing how incentive design and cognitive biases play out on platforms like DEX Screener, users can better calibrate risk maps, employ loss aversion heuristics, and optimize portfolio stress tests. This meta-cognition is the key to turning an analytics paradox into a strategic advantage.

Reframing the Crypto Analytics Landscape: What Every Trader Must Know

DEX Screener epitomizes the complex interplay between cutting-edge blockchain technology and human psychology in DeFi’s wild frontier. Its unparalleled data infrastructure democratizes access to multi-chain analytics, while its monetization strategies reveal the darker side of crypto attention economies. For traders seeking to buy, sell, or profit from crypto, the platform is both a lighthouse and a labyrinth.

Embracing this duality requires shedding naive assumptions about transparency and trust. Instead, traders must adopt a layered approach: leveraging DEX Screener’s real-time insights while maintaining skepticism about promoted tokens and algorithm-driven trends. This nuanced stance transforms the platform from a potential “trap” into a powerful tool for informed decision-making.

For those ready to explore this frontier with eyes wide open, powerful tools await. You can dexscreener offers a free, richly featured platform that integrates seamlessly with TradingView analytics, enabling traders to customize alerts, track whales, and navigate the DeFi ecosystem with greater precision. This is not just about data—it’s about mastering the behavioral currents that shape crypto markets.

Questions That Change Everything

Is trusting a platform like DEX Screener inherently dangerous if it promotes scam tokens?

Trust in crypto analytics is not binary. DEX Screener’s data accuracy is top-tier due to direct blockchain indexing, but its promotional model introduces noise and risk. The key is to combine its insights with behavioral awareness and independent research, treating promoted tokens as signals to scrutinize, not endorsements.

How can traders protect themselves from cognitive biases when using real-time DeFi analytics?

Awareness of biases like FOMO, anchoring, and loss aversion is the first step. Using tools like customizable alerts and portfolio stress tests can help manage emotional triggers. Diversifying data sources and applying meta-cognitive reflection—questioning why you want to trade—are critical defenses.

Will regulatory crackdowns force platforms like DEX Screener to change their business models?

Almost certainly. As regulators target deceptive advertising and market manipulation in DeFi, platforms monetizing paid listings without moderation may face restrictions. This could prompt shifts toward greater transparency, stricter token vetting, or alternative revenue streams, reshaping the analytics landscape.