Why DEX Screener’s Scam Token Paradox Reveals the Future of Crypto Analytics

Stop and read this twice: the platform heralded as the pinnacle of decentralized exchange analytics thrives by showcasing the very scams that threaten its existence. This is not a glitch or a failing—it’s a blueprint for a new era in crypto trading, where trust and deception intertwine in a delicate dance. Yet, buried beneath the controversy lies a secret mechanism reshaping how traders perceive risk, opportunity, and control. To decode this paradox is to glimpse the future of on-chain analytics, where algorithmic transparency meets behavioral economics, and every whale move or token unlock triggers a psychological ripple far beyond mere numbers.

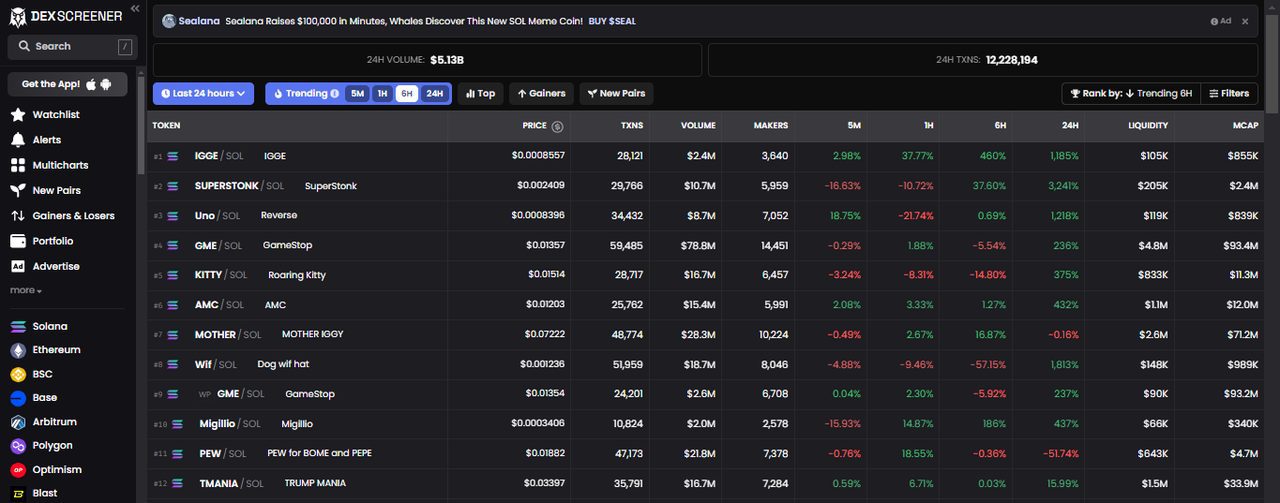

The Freemium Mirage: How Scam Tokens Power the Largest DEX Analytics Engine

At first glance, DEX Screener’s model seems straightforward: provide free real-time, multi-chain analytics to 1.5 million monthly users while monetizing token listings and paid promotions. But here’s the twist—its core revenue, estimated at $150,000 to $250,000 daily, stems predominantly from the very listings accused of being scams. The platform’s “dark pattern” business model leverages the human cognitive bias of social proof and urgency, placing paid tokens in prominent trending spots and thus creating a self-reinforcing cycle of hype and FOMO. This paradoxical alignment of incentives exposes a fundamental truth: in crypto, trust is not binary but a spectrum modulated by perception, not just facts.

Behind the scenes, DEX Screener’s proprietary blockchain indexer parses raw on-chain data across 80+ blockchains with unmatched speed and granularity. Yet this technical prowess coexists uneasily with reputational risks—criticisms from industry leaders like Coinbase’s Conor Grogan highlight the platform’s reliance on advertising revenue from questionable tokens. This duality reveals a broader systemic tension in DeFi analytics: the need to balance transparency with curated reliability, free access with profitable gatekeeping.

Behavioral Alpha in Action: How Traders Navigate the ‘Scam Token Signal’

Conventional wisdom warns traders to avoid scam tokens at all costs. But DEX Screener’s data suggests a subtler dynamic at play—some savvy traders exploit the volatility and liquidity heatmaps of these tokens to execute cross-DEX arbitrage, flash-loan strategies, or even MEV (Miner Extractable Value) exploits. By offering real-time whale tracking, token unlock alerts, and social sentiment indicators, the platform becomes a behavioral coaching bot, nudging users to recognize early demand signals and manage FOMO effectively.

This creates a paradoxical “behavioral alpha” where risk-averse heuristics are challenged by rational actors who thrive on bounded rationality and prospect theory’s nuances. Traders learn to calibrate their loss aversion and regret minimization tactics not by avoiding scams but by timing entry and exit points precisely—turning what appears as noise into a strategic advantage. Such dynamics redefine the utility curve of decentralized trading, where impermanent loss hedging and slippage protection become psychological as well as financial strategies.

From Data to Decision: The Hidden Role of Nudge Design in DEX Screener’s UX

Underneath the seemingly chaotic token listings lies an intricate layer of nudge design and information asymmetry management. DEX Screener’s interface leverages urgency effects, dynamic pool fees display, and trend-reversal alerts that guide user attention subtly without explicit warnings about scam risks. This creates a cognitive load that both empowers and disorients traders, compelling them to rely on heuristics like anchoring bias and social proof embedded in trending scores.

More than a tech dashboard, the platform acts as a behavioral marketplace where attention economy dynamics govern which tokens gain liquidity and which fade into obscurity. This is a powerful form of “reputational staking” by token projects, where paid boosts and advertising packages translate into psychological capital on the platform. The result is a complex ecosystem where trader onboarding and retention tokenomics are as much about perception management as about raw data.

Why Regulatory Blind Spots in DeFi Analytics Could Backfire on Everyone

Despite its impressive growth—boasting over 12 million monthly visits and revenues surpassing $50 million annually—DEX Screener operates in a regulatory gray zone. Its Delaware incorporation and remote operational footprint give it legal flexibility, yet the platform’s monetization via paid token listings, including scam tokens, poses a looming compliance risk. The paradox is stark: in seeking to democratize decentralized finance, the platform amplifies regulatory scrutiny that could disrupt the entire DeFi analytics ecosystem.

This legal ambiguity forces a reconsideration of how “trust heuristics” function in decentralized environments. Unlike centralized exchanges with strict KYC/AML procedures, platforms like DEX Screener rely on market-driven moderation and community reporting. Yet the prevalence of scam token promotion threatens to erode user trust, triggering a vicious cycle that could lead to liquidity flight and increased volatility—ironically harming the very traders the platform serves.

To navigate this, DEX Screener must innovate beyond traditional analytics—embracing transparency cues, enhanced due diligence features, and perhaps even integrating behavioral KPIs to detect and mitigate reputational risk in real time. This evolution could redefine what it means to be a trusted source in the age of decentralized finance.

Unlocking the Future: How DEX Screener’s Paradox Drives the Next Wave of Crypto Innovation

What if the DEX Screener paradox—the coexistence of scam token promotion and market leadership—is not a failing but a feature of the emergent crypto landscape? This paradox catalyzes innovation in automated price alerts, Telegram trading bots, and multichart correlation analytics that empower traders to harness volatility instead of fearing it. By embracing the behavioral economics underlying FOMO, loss aversion, and regret minimization, platforms can design smarter, frictionless UX that anticipates trader psychology rather than reacting to market chaos.

Integrating advanced features such as gas-fee optimization, slippage protection, and MEV analysis within a nudge-informed interface transforms passive data consumption into active decision support. This creates a “behavioral alpha loop,” where traders not only respond to but anticipate market shifts, turning decentralized analytics from a raw information feed into a strategic partner.

In this light, DEX Screener’s controversial model presages a future where crypto analytics platforms become behavioral coaching bots—guiding traders through the cognitive minefield of DeFi with real-time adaptive intelligence. To join this revolution, traders and projects alike must embrace the complexity and ambiguity inherent in decentralized markets, recognizing that trust is a dynamic spectrum shaped by data, psychology, and design.

For those ready to experience this paradigm firsthand, the gateway is clear. You can go here to access the platform that embodies this new frontier of crypto analytics and join the ranks of traders who see beyond the paradox.

Questions That Change Everything

Is promoting scam tokens on DEX Screener a deliberate strategy rather than negligence?

Yes. While controversial, DEX Screener’s business model leverages paid listings and boosts, including from risky tokens, as a revenue engine. This creates a calculated trade-off between short-term profit and long-term reputational risk, reflecting a new “attention economy” where visibility often trumps vetting.

Can traders realistically use scam token data for profitable strategies without falling victim?

Surprisingly, yes. Sophisticated traders exploit behavioral signals, whale tracking, and timing alerts to engage in arbitrage and MEV strategies. This requires nuanced understanding of bounded rationality and risk budgeting, transforming apparent noise into actionable alpha.

Will regulatory frameworks eventually force platforms like DEX Screener to change their monetization models?

Almost certainly. As regulators catch up with DeFi’s rapid growth, platforms will need to embed compliance and enhanced transparency into their core design, possibly shifting from pure advertising revenue to hybrid models integrating institutional partnerships and vetted token listings.