Why The Most Trusted Crypto Analytics Platform Is Also Its Own Biggest Risk—and What This Means for Your Trades

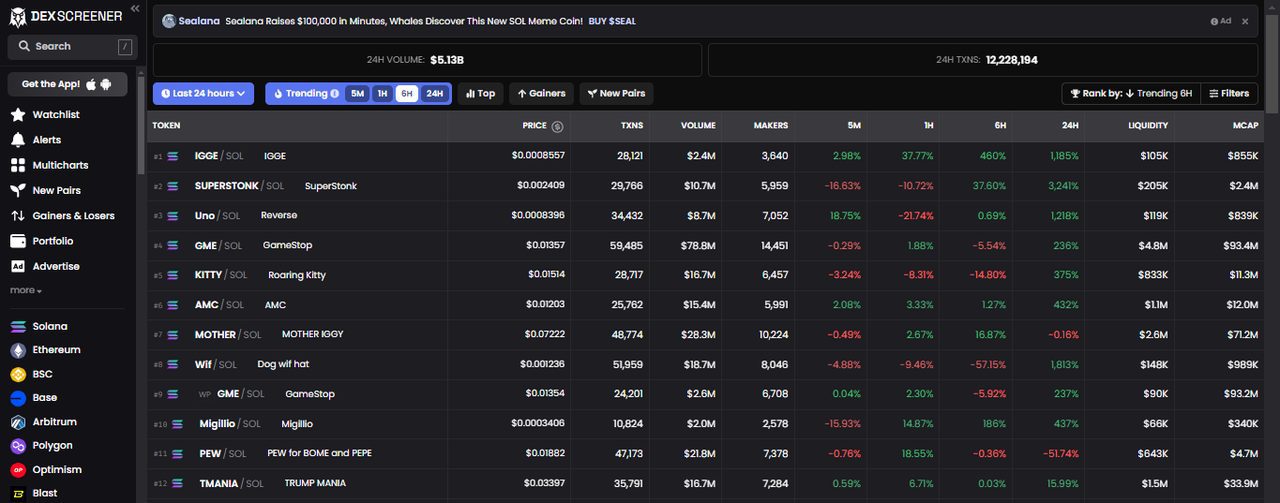

Imagine a platform that tracks over 80 blockchains in real time, serves millions of traders daily, and generates hundreds of thousands in revenue every single day—all run by fewer than a dozen people. Now imagine that same platform is simultaneously hailed as a market leader and condemned as the playground for scam tokens. How can the most powerful tool in decentralized finance also be a vector of distrust and regulatory alarm? This paradox isn’t just an industry quirk; it’s a window into the complex incentives shaping crypto analytics today. Beneath the surface of sleek charts and whale trackers lies a tension between rapid growth, monetization pressures, and user safety. Today, we pull back the curtain on DEX Screener, dissecting how its meteoric rise, controversial business model, and technological prowess converge to rewrite what it means to trust data in DeFi—and what it means for you as a trader.

The Invisible Engine: How A Tiny Team Powers a $250 Million Behemoth

At first glance, the scale of DEX Screener’s operation feels like a Silicon Valley fantasy: over 1.5 million active monthly users, integration with TradingView’s Supercharts, and lightning-fast updates from 80+ blockchains—all managed by fewer than 10 employees. This defies conventional wisdom that big data and high-frequency analytics require sprawling teams. The secret lies in their proprietary blockchain indexer, which parses raw blockchain logs directly from nodes, avoiding the latency and inaccuracies of third-party APIs. This “digital microscope” continuously scans millions of on-chain transactions, enabling real-time analytics that traders demand. The result? A platform that punches far above its weight in user engagement and financial performance, with an estimated annual revenue north of $250 million—translating to a jaw-dropping $25-31 million revenue per employee ratio.

This operational alchemy isn’t just efficient; it’s a manifestation of automation’s power in Web3. Yet, this razor-thin team also means every strategic choice—from moderation policies to product innovation—ripple instantly through the platform’s ecosystem. The paradox here is clear: their technological moat fuels growth but also concentrates risk and responsibility in a way few competitors face.

Here emerges the first micro-revelation: in the world of DeFi analytics, size doesn’t equal strength—technology-driven agility does. But agility without guardrails can become a double-edged sword.

When Monetization Meets Market Manipulation: The Dark Side of Token Promotion

Despite soaring popularity, DEX Screener’s business model resembles a high-wire act balancing free access with lucrative token advertising. Token projects pay a $300 fee just to get basic listing with logo and social media info, while premium advertising campaigns can exceed $100,000. The platform even offers “boost” packages and a launchpad for meme coins, with an 80% revenue share model. This freemium paradox—free core analytics subsidized by paid promotions—generates stable, massive daily revenues estimated between $150,000 and $250,000.

But this model has a shadow: industry criticism and reputational risk. In early 2025, DEX Screener faced public backlash for allegedly promoting scam tokens through paid listings. Coinbase’s Head of Product Operations publicly accused the platform of “dark patterns” that prioritized paid tokens on the front page, potentially funneling $200 million in annual revenue from questionable projects. Users report being misled by trending scores and manipulated visibility, raising the specter of market manipulation cloaked as analytics.

Here’s the twist: a platform designed to empower traders with transparency simultaneously enables predators to exploit that transparency for profit. This “incentive asymmetry” is a rare beast—where the user’s trust is the very currency being traded behind the scenes.

Understanding this duality reframes how we consider trust in decentralized analytics—not as a fixed property, but as a fragile ecosystem vulnerable to commercial pressures and regulatory scrutiny.

From Whale Tracking to FOMO Traps: Behavioral Economics Meets On-Chain Data

Another layer to this paradox lies in the behavioral dynamics that DEX Screener both reveals and amplifies. Features like whale tracking, proprietary trending algorithms, and instant price alerts tap directly into trader psychology—leveraging FOMO, loss aversion, and social proof to drive engagement. Yet, these same features can catalyze irrational overtrading, herd mentality, and susceptibility to pump-and-dump schemes.

For example, “whale watch” alerts signal large token movements, often sparking frantic buy-ins from retail traders fearing to miss out. But this can lead to “reflexivity loops,” where trader behavior influences price action that in turn feeds back into the alerts—creating volatility spikes detached from fundamental value. The platform’s own “boost” services can exacerbate this by artificially inflating trending scores, nudging traders toward promoted tokens.

In this light, DEX Screener acts as both a mirror and a magnifier of crypto market psychology—turning behavioral insights into monetizable signals but at the risk of amplifying cognitive biases like anchoring and regret minimization. This dynamic challenges the notion that on-chain analytics are purely objective, spotlighting the interplay between data, design, and decision-making.

This insight pushes us to question: Are traders harnessing data, or are data platforms harnessing trader behavior?

Regulatory Crossroads: Navigating Compliance Without Compromising Growth

Operating as a Delaware C-Corp with a remote team headquartered in Miami, DEX Screener walks a regulatory tightrope. Its business model, reliant on token advertising and paid promotions, invites scrutiny amid increasing global crackdowns on crypto scams and deceptive marketing. While no public lawsuits have surfaced, reputational risks and potential regulatory investigations loom large, especially given the platform’s role in amplifying potentially fraudulent tokens.

The lack of explicit ESG initiatives or corporate social responsibility reporting adds to concerns about governance transparency. Moreover, the platform’s massive daily revenue from token advertising—some reportedly linked to scam projects—raises questions about compliance with anti-fraud and consumer protection laws.

The paradox here is stark: to remain a market leader, DEX Screener must innovate and monetize aggressively, yet these very imperatives expose it to regulatory blowback that could imperil its business model. This “regulatory paradox” is a microcosm of DeFi’s broader challenges—balancing decentralization and innovation with accountability and trust.

For traders, this means vigilance is not just advisable but essential—trusting platforms requires understanding the invisible forces shaping their incentives and vulnerabilities.

Embracing the Paradox: How Traders Can Turn DEX Screener’s Contradictions into Opportunity

So what does this paradox mean for you, the trader seeking to buy and sell crypto profitably? The answer lies in mastering the dual nature of platforms like DEX Screener—leveraging their unmatched real-time data and multichain coverage while navigating their monetization-driven biases.

Personalizing alerts, cross-referencing trending tokens with independent on-chain analytics, and using features like multi-chart correlation and whale tracking thoughtfully can transform potential FOMO traps into strategic signals. Furthermore, integrating behavioral insights—such as managing loss aversion and avoiding overtrading—can mitigate the pitfalls of reflexivity loops amplified by paid promotions.

For those ready to go deeper, combining DEX Screener’s data with complementary tools like Dune Analytics can provide layered insights that cut through noise and hype. By understanding the incentives behind token boosts and advertising, savvy traders can better filter signal from noise, turning the platform’s paradoxical nature into an edge rather than a liability.

If you want to explore this cutting-edge toolkit and enhance your trading decisions, you can go here to download DexScreener and start harnessing its power with eyes wide open.

Ultimately, the key revelation is that in the fragmented, fast-evolving DeFi landscape, no analytics platform is neutral. Recognizing and embracing this complexity is the first step toward trading smarter and safer.

Questions That Change Everything

Is it safe to trust DEX Screener’s trending scores given their paid promotion model?

Trending scores are influenced by both organic activity and paid boosts, meaning they reflect a blend of real market interest and marketing spend. Traders should treat them as one input among many, corroborating with independent on-chain data and fundamental research to avoid falling prey to manipulated hype.

Can a small team truly manage data accuracy and security at this scale?

Yes, thanks to proprietary automated blockchain indexers and microservices architecture, a lean team can maintain high data accuracy with minimal manual intervention. However, this efficiency also means less human oversight on content moderation, which can allow scam tokens to slip through without robust governance mechanisms.

How can traders protect themselves from the behavioral traps amplified by platforms like DEX Screener?

Understanding cognitive biases such as FOMO, loss aversion, and anchoring is vital. Traders should use features like custom alerts and multi-chart displays to build disciplined strategies, avoid chasing hype, and apply risk budgeting principles. Behavioral coaching bots and portfolio stress tests integrated with analytics platforms are emerging tools to help manage these psychological risks.