Why the Most Trusted Crypto Analytics Platform Is Also the Riskiest Bet for Traders—and How This Paradox Could Make You Richer

Imagine a platform that millions rely on every day to navigate the chaotic seas of decentralized exchanges, yet behind its sleek interface hides a labyrinth of risks that could sabotage your portfolio. You’d think a top-ranked analytics hub with over 12 million monthly visits would be a fortress of trust and safety. Instead, it’s a high-wire act balanced on the razor edge of reputation, regulatory scrutiny, and the very incentives that fuel its growth. But what if this paradox—the coexistence of immense utility and profound risk—is the secret sauce that savvy traders can exploit? The solution lies not in avoiding the platform but in mastering its hidden dynamics. Let’s unravel why the dominant DeFi analytics giant, DEX Screener, embodies this contradictory reality and how it reshapes the rules of crypto trading for those bold enough to go beyond surface trust.

The Trust Paradox: How a Small Team Became the Giant With a Double-Edged Sword

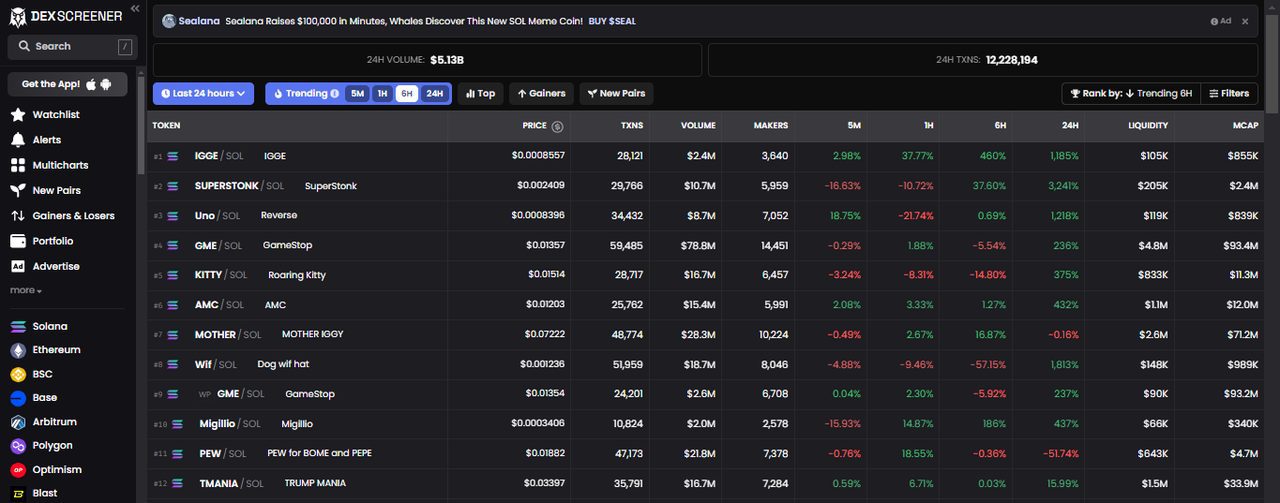

DEX Screener’s rise to dominance is nothing short of astonishing. With just 8-10 remote employees, it processes real-time data from over 80 blockchains, serving 1.5 million monthly active traders who depend on its pinpoint analytics for split-second decisions. This operational feat, powered by proprietary blockchain indexing technology, generates over $50 million annually through token listing fees and advertising—a staggering $25-31 million per employee. Such efficiency creates a technical moat invisible to most competitors. Yet, here lies the paradox: despite its technological prowess and market leadership, DEX Screener’s revenue model heavily relies on paid listings and promotional services that often spotlight scam tokens. This “freemium paradox” means while traders get free, invaluable data, the platform simultaneously profits from the very tokens that can imperil those traders’ investments. The tension between providing transparent, trustworthy data and monetizing through paid token promotion fuels ongoing reputational risks and skepticism from the crypto community.

This paradox is amplified by the platform’s refusal to moderate listings stringently, leading to accusations from industry insiders, including Coinbase’s Head of Product Operations, that DEX Screener acts as a “hub for predatory investors.” The platform’s lack of public response to these criticisms intensifies distrust, yet its user base keeps growing—an astonishing contradiction that hints at a deeper behavioral phenomenon at play.

Down the Rabbit Hole: Why Traders Keep Coming Back Despite the Red Flags

Why do millions flock to a platform accused of showcasing scam tokens and using ‘dark patterns’ that favor paid promotions? The answer may lie in the psychology of crypto trading itself—where FOMO (fear of missing out), social proof, and herd behavior often override caution. DEX Screener’s integration with TradingView charts, real-time whale tracking, and automated price alerts create a compelling ecosystem that feeds traders’ urge to act quickly on early demand signals and social sentiment shifts.

This environment creates what I call the “Trust-Risk Feedback Loop”: traders rely on DEX Screener’s data to spot opportunities, some of which are artificially boosted by paid promotions, which in turn attract more users chasing the hype, generating more revenue for the platform. This cycle thrives on bounded rationality—traders’ limited cognitive resources lead them to anchor on trending tokens despite red flags. Yet, this loop also seeds the conditions for profitable arbitrage and strategic positioning by those who understand the underlying incentives and can navigate the blurred lines between organic trends and paid hype.

For traders willing to embrace this complexity, dexscreener’s tools become a powerful weapon rather than a liability. Automated alerts, multi-chart correlation, and whale tracking can be used to detect artificial pumps early. The platform’s expansive multi-chain coverage allows cross-DEX arbitrage strategies that exploit momentary price dislocations amplified by promotional boosts. The key is not blind trust but informed skepticism coupled with tactical agility—a mindset shift that turns the platform’s paradox into an edge. If you want to go here and harness this edge, mastering the platform’s nuances is essential.

The Hidden Architecture: How Proprietary Technology Enables Both Transparency and Manipulation

At the heart of DEX Screener’s paradox is its proprietary blockchain indexer, a technological marvel that parses raw blockchain logs across more than 80 Layer 1 and Layer 2 networks without relying on third-party APIs. This approach ensures data accuracy and real-time updates every few seconds, supporting millions of users seamlessly. However, this same infrastructure inadvertently enables the rapid listing and promotion of new tokens, including those designed for pump-and-dump schemes.

The platform’s microservices architecture and deep partnerships—most notably with TradingView—offer unparalleled charting and analytical capabilities. Yet, the “Boost” and “Moonshot” promotion packages, some costing over $100,000, create a marketplace where visibility can be bought, blurring the line between unbiased analytics and paid advertising. Unlike traditional financial platforms with stricter gatekeeping, DEX Screener’s decentralized ethos and competitive pressures have led to a laissez-faire approach to content moderation.

This creates what I term the “Transparency Mask”: while the data appears fully open and real-time, the underlying incentive structures shape what trends emerge and which tokens dominate user attention. Traders must recognize that the platform’s transparency is filtered through commercial priorities. This insight reframes how one approaches DeFi analytics—not as a neutral oracle, but as a dynamic ecosystem where data, incentives, and human psychology intersect.

From Paradox to Profit: How to Navigate the DEX Screener Ecosystem With Behavioral Mastery

Most trading advice focuses on technical indicators or fundamental analysis. But DEX Screener’s paradox demands a new layer: behavioral alpha. Understanding cognitive biases—anchoring, loss aversion, disposition effect—and how they interact with the platform’s design can transform your trading outcomes.

For example, the platform’s token unlock alerts and whale tracking features can help detect early supply shocks or manipulative whale moves, allowing traders to anticipate volatility before it hits mainstream awareness. Similarly, leveraging automated price alerts and webhook integrations with Telegram bots enables rapid response to momentum shifts, reducing the risk of overtrading driven by FOMO or panic.

Moreover, strategic use of multichart correlation across DEXs offers insights into slippage protection and MEV (miner-extractable value) risks—critical for optimizing cross-chain arbitrage and yield farming strategies. By combining these technical tools with a deep understanding of trader psychology and incentive structures, you create a hybrid strategy that exploits the platform’s paradox rather than falling victim to its pitfalls.

In practice, this means cultivating “meta-awareness”: constantly questioning whether a token’s surge is organic or fueled by paid promotion, and adjusting portfolio stress tests accordingly. It also entails using DEX Screener’s free core features judiciously while selectively engaging with promotional signals as contrarian indicators rather than endorsements.

The Future Unfolding: Why the DEX Screener Paradox Is a Microcosm of DeFi’s Next Decade

The DeFi sector is on a trajectory to reach $616 billion by 2033, with decentralized exchanges handling billions daily. Platforms like DEX Screener are not just analytics tools but battlegrounds where trust, technology, and tokenomics collide. The paradox it embodies—between enabling transparency and facilitating manipulation—reflects broader systemic tensions in decentralized finance.

As regulatory scrutiny intensifies, platforms must evolve or risk obsolescence. DEX Screener’s current model, reliant on high-volume token advertising and minimal content moderation, faces potential upheavals. Yet, its technological foundation and user loyalty position it to pioneer new paradigms of decentralized analytics and behavioral coaching bots that nudge traders toward better risk management.

For the trader willing to decode this paradox, the opportunity is immense. The platform’s expanding user base, growing institutional interest, and integration into ecosystems like TradingView signal that mastery over this complex environment will become a defining skill. In this light, DEX Screener is not a problem to avoid but a puzzle to solve—a mirror reflecting the future of crypto trading’s delicate dance between chaos and control.

Questions That Change Everything

Is it safe to trust DEX Screener’s token listings if many are paid promotions?

Safety in crypto is never absolute, but understanding that paid listings are a double-edged sword is crucial. Rather than trust blindly, use the platform’s data as a directional tool while applying behavioral filters—watch for signs of artificial boosts, cross-validate with other analytics, and never invest solely on token visibility.

Can traders actually profit by exploiting the platform’s ‘dark pattern’ promotion system?

Yes, but only if they adopt a contrarian mindset. Recognizing when a token’s hype is fueled by paid promotion allows savvy traders to anticipate pump-and-dump cycles, execute timely arbitrage, and manage risk through advanced alerting systems. This requires behavioral discipline and technical agility rather than passive reliance.

Will regulatory pressure end this paradox or transform it?

Regulation will likely force platforms like DEX Screener to increase transparency around paid promotions and implement stronger content moderation. However, the paradox will persist in new forms as incentives and behavioral biases remain core to market dynamics. Traders who understand this will adapt faster and capitalize on emerging opportunities.